The Talivity Talent Market Index offers a fresh perspective on talent supply and demand dynamics across industries. It tracks the fluctuating prices employers pay to attract talent through paid advertising across diverse media channels. Unlike traditional metrics like job openings and hiring volume, the Index reveals nuanced changes in talent demand—delivering early signals even when job volume stays flat.

In this report:

Watch the LinkedIn Live Replay

Key Findings

Resilience Meets Retrenchment: The Market Holds While Uncertainty Swells

- April’s labor market delivered another upside surprise with 177,000 jobs added, even as employer layoffs surged 60% onth-over-month—largely due to government restructuring. Unemployment held steady at 4.2%. But beneath the surface, competing signals are shaping cautious, calculated hiring strategies.

- The May Talent Market Index shows broad-based declines in talent attraction prices across all job segments, pointing to more available talent—or more selective employers.

- According to Recruitics’ data, applications per job dropped to 4.8 in April. Down from 5.6 the same time last year, and well below the 2024 average of 7.9

- Employers are navigating complexity, not collapse. Tariff uncertainty, sentiment dips, and shifting location strategies are shaping spend. In sectors like healthcare, hospitality, and logistics, demand remains strong, even as prices fluctuate. It’s not a pullback—it’s a recalibration.

Segment Analysis

Healthcare

Talent attraction prices in healthcare declined 4.31% month-over-month and are down 10.48% year-over-year, signaling a modest easing in recruitment costs.

However, the drop does not necessarily indicate softening demand. The sector added 51,000 jobs in April, continuing a year-long trend of steady growth driven by an aging population and increased healthcare utilization.

Rising Medicare enrollment is placing sustained demand on providers and support staff, while proposed federal Medicaid reimbursement cuts are introducing new financial pressures—particularly for systems in rural or underserved areas. These funding shifts may further restrict resources available for recruitment and retention, worsening existing staffing gaps.

Despite short-term pricing relief, the competition for qualified healthcare talent remains high. Employers should anticipate regional disparities in labor availability and prepare for cost pressures to resurface.

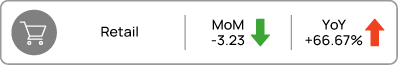

Retail

Seasonal hiring recalibrated in April, with talent attraction prices dropping slightly month-over-month. Still, prices remain well above 2024 levels year-over-year, indicating that competitiveness for key roles—especially in logistics, merchandising, and customer experience—has not disappeared.

So far in 2025, the retail sector has shed 64,000 jobs—a significant increase from the same period last year, when job losses were far more modest. This signals a notable shift in workforce dynamics, with employers pulling back amid macroeconomic pressure.

As tariffs take effect and consumer behavior shifts toward price sensitivity, many retailers are facing a tough reality: lower demand, tighter margins, and less room to hire. With fewer resources and softer spending, hiring strategies are becoming leaner and more targeted—reshaped by both economic constraints and shifting shopper expectations.

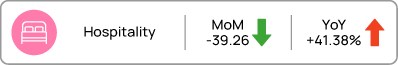

Hospitality

Talent attraction prices in the hospitality sector dropped 39% month-over-month in March, yet remain over 41% higher year-over-year, signaling persistent long-term cost pressures despite recent short-term easing.

According to the April 2025 BLS Jobs Report, the leisure and hospitality sector added 24,000 jobs—a significant jump from just 5,000 added in April 2024, and well above the sector’s 12-month average of 16,000 monthly gains. This suggests strong hiring momentum as the industry heads into peak season.

While international travel is expected to soften, much of the hiring activity appears to be driven by robust domestic demand. Employers are planning for a busy summer—particularly in travel-heavy U.S. regions—despite potential global headwinds.

With peak hiring underway, expect continued pricing volatility and regional competition. Employers should be prepared for fluctuating labor costs and staffing challenges, especially in areas dependent on seasonal and service-oriented workers.

IT & Related

Talent attraction prices for IT and related roles declined 19% month-over-month and are down 10.75% year-over-year, marking a meaningful shift from the sustained cost pressures observed throughout 2024. According to the April 2025 BLS Jobs Report, employment in the information sector showed little or no change, and professional and business services—which includes many tech roles—remained relatively stable.

The drop in prices likely reflects a combination of factors: strategic hiring slowdowns, a shift toward contract-based staffing, and increased scrutiny of tech investments. But the real driver here is AI—which is both reducing demand for certain traditional roles and simultaneously accelerating demand for specialized AI talent. As automation initiatives scale and organizations race to build internal capabilities, competition for high-skill, high-impact roles will remain intense—keeping volatility in this category high.

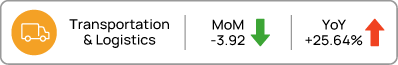

Transportation & Logistics

Talent attraction prices in the transportation and logistics sector declined 3.92% month-over-month in April but remained 25.64% higher year-over-year, pointing to sustained cost pressure despite short-term fluctuations.

According to the BLS April 2025 Jobs Report, the sector added 27,000 jobs, continuing steady momentum after a strong Q1. This growth was driven largely by gains in warehousing, trucking, and delivery services, reflecting ongoing demand across supply chain operations.

Tariff pressures and immigration constraints could amplify costs further, especially for licensed drivers, warehouse associates, and last-mile delivery roles. Employers are still playing offense in essential logistics hiring, balancing immediate needs with long-term strategy as they navigate global supply chain disruptions and labor availability challenges.

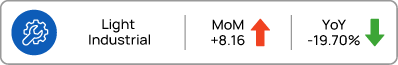

Light Industrial

Talent attraction prices for light industrial roles increased 8.16% month-over-month—making it the only job segment to see a price increase in April. However, prices remain down 19.7% year-over-year, reflecting a broader trend of easing costs compared to 2024.

According to the April 2025 BLS Jobs Report, employment in manufacturing showed little or no change over the month, indicating that while overall hiring volume is stable, competition may be rising in specific markets or roles such as machine operators, assemblers, and warehouse staff.

The uptick in prices may reflect localized demand spikes, supply chain adjustments, or seasonal labor shifts. Still, with tariffs and automation trends looming, employers should watch for continued volatility and be ready to adapt their recruiting approach in the months ahead.

Food Services

Talent attraction prices in food services declined 6.12% month-over-month and are down 25.8% year-over-year—marking the steepest annual decline across all sectors in the Talent Market Index. This may reflect improved labor availability or stabilizing employer demand, particularly for part-time and entry-level roles.

According to the April 2025 BLS Jobs Report, the food services and drinking places category added 27,000 jobs, notably up from the 22,000 jobs added in April 2024. This suggests a steady recovery and sustained consumer demand for in-person dining experiences.

Despite easing prices, challenges remain. Regional wage competition, scheduling complexity, and immigration policy shifts could still impact labor supply and employer costs. As we move into the summer season, employers should stay alert for renewed volatility—especially in urban and high-traffic markets.

Looking Ahead: What to Watch for in the Summer

- Tariff Talk Turns to Talent Talk

Shifting trade policies are beginning to affect workforce decisions—especially in manufacturing and logistics. Expect employers to emphasize cost control, adjust hiring timelines, or shift to part-time strategies. - Sentiment Slides, Storytelling Rises

With consumer expectations at a 12-year low and job seeker sentiment down 3.6 points, employer brand storytelling and recruitment marketing will be critical to attracting passive talent. - Healthcare Heats Up

No relief in sight. Continued shortages and immigration constraints will keep CPA high, pushing employers to experiment with creative sourcing, AI-assisted outreach, and nontraditional pipelines. - Hospitality's Summer Stress Test

The next 90 days will be pivotal. Will prices normalize—or surge again as vacation season hits full stride? Regional demand spikes may require faster hiring cycles and retention incentives.

If you’d like to understand how these trends impact your company, explore our strategic consulting services and connect with one of our experts for a tailored discussion.