The Talivity Talent Market Index offers a fresh perspective on talent supply and demand dynamics across industries. It tracks the fluctuating prices employers pay to attract talent through paid advertising across diverse media channels. Unlike traditional metrics like job openings and hiring volume, the Index reveals nuanced changes in talent demand—delivering early signals even when job volume stays flat.

In this report:

Watch the LinkedIn Live Replay

Key Findings

Labor Market Holds Steady, But Strategic Shifts Are Accelerating

- The U.S. added 147,000 jobs in June, with unemployment holding at 4.1% and labor force participation slipping to 62.3%—signaling a cooling but still competitive labor environment.

- 7 of 9 sectors posted MoM price gains, led by Sales (+78.7%), Hospitality (+53.2%), and Finance & Ops (+33.3%), pointing to a focused push in revenue-driving and seasonal roles.

- YoY pricing trends diverged sharply: Sales, Retail, and Hospitality saw double-digit increases, while IT, Light Industrial, and Healthcare remained deflationary, reflecting recalibrated priorities—not collapse.

- Strategic investment is rising in AI, logistics, and core operational functions. At the same time, seasonal stress is peaking in food service, retail, and hospitality—forcing employers to act fast.

Segment Analysis

.png?width=654&height=368&name=Talent%20Market%20Index%20by%20Job%20Family%2c%20US%20(3).png)

Healthcare

Early policy tremors, not aftershocks—employers should act before the next wave.

What’s Shaping the Market:

Healthcare added 39,200 jobs in June 2025, down from both May’s 62,000 and June 2024’s 49,000. Attraction prices nudged up +2.9% MoM but are still –15% YoY, offering a rare window of affordability in a structurally constrained sector. But that stability may be short-lived:

- Immigration constraints are tightening the supply funnel: Legal uncertainty and visa slowdowns are affecting tens of thousands of immigrant workers, particularly in direct care, nursing homes, and home health—roles already difficult to staff.

- Medicaid funding shifts are beginning to ripple: Cuts are reshaping employer behavior in rural and nonprofit systems. While large-scale layoffs haven’t hit, we’re already seeing slowed hiring in home-based and community care roles.

- Pipeline expansion is real—but delayed: Federal workforce funding is flowing, but it’s mostly earmarked for training and credentialing. The impact on available licensed staff won’t materialize until mid-to-late 2026.

- Workforce pressure is mounting internally: Increased union activity and burnout concerns are leading some systems to reconsider their retention playbooks—especially in high-churn inpatient roles.

What This Means for You:

Don’t wait for the disruption to show up in headline stats—by then, the window will be gone. Right now, you have room to hire before incentive wars and retention shocks return. Prioritize underserved regions, reframe job messaging around growth and purpose, and fortify staffing strategies tied to immigration-dependent roles. Summer 2025 may be the last calm period before structural constraints tighten again in early 2026.

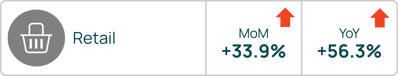

Retail

What’s Shaping the Market:

- Retail added just 2,400 jobs in June, far below pre-pandemic norms and softer than June 2024. Though attraction prices jumped +33.9% MoM and are now +56.3% higher YoY, the sector’s index remains well below baseline at 0.75.

- This divergence reflects a market in pause, not in growth. June’s data captures the tail end of spring hiring—but July marks the real start of back-to-school hiring, especially in fulfillment, merchandising, and support roles. That seasonal surge is expected to be shorter and more selective than in prior years.

Adding to the pressure:

- Store closures are accelerating: Over 5,800 U.S. stores have shut so far in 2025, and forecasts now project 15,000 closures by year-end.

- Tariff-driven cost pressure is reshaping promotional strategy. Forbes reports that more than 60% of Amazon sellers scaled back or canceled Prime Day discounts, citing rising input costs—especially on apparel and aluminum goods.

- Job seeker confidence is dropping: Retail candidate sentiment fell to 39.3% in June, down 8 points since January, according to Talivity Talent TrendWatch.

What This Means for You:

As July kicks off the condensed back-to-school hiring window, act decisively—but selectively. Prioritize markets tied to inventory movement and revenue reliability. If you’re in softlines or tariff-sensitive segments, hiring agility will be more important than scale. And if you’re planning fall campaigns, expect slower application flow unless ads are geo-targeted, mobile-optimized, and conversion-focused.

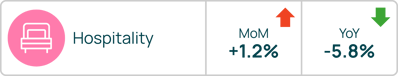

Hospitality

Summer travel demand remains solid, but early signs suggest uneven footing beneath the surface.

What’s Shaping the Market:

The hospitality sector added 20,000 jobs in June 2025, a slowdown from May’s 48,000 and below the typical summer surge pace. Attraction prices ticked up just +1.2% MoM and remain –5.8% below last year—suggesting that while demand persists, employers are growing more cautious.

The sector continues to benefit from strong domestic leisure travel, especially in drive-to destinations and event-based markets. But key friction points are forming—and some may intensify heading into late summer:

- Labor availability remains patchy, particularly in luxury and resort markets where staffing needs are most acute. H-2B visa backlogs are disrupting onboarding timelines for international seasonal workers.

- Regional travel soft spots are emerging: Hawaii, for example, is reporting lower-than-expected summer tourism volumes, partly due to rising costs and infrastructure strain.

- Sustainability and tech-forward guest services are now must-haves, not differentiators. Many employers are restructuring job roles to prioritize digital concierge, group event staffing, and wellness-focused positions.

- Union momentum is growing, adding complexity to scheduling, onboarding, and incentive strategies in larger chains.

What This Means for You:

The July-August window still offers strong hiring potential—but only if you're geo-targeted and fast. Focus on regions with clear demand signals and be proactive about pipeline depth, especially in roles affected by visa caps or seasonal churn. If you’re in markets with softening tourism, use this time to optimize internal mobility and retention. And as candidate expectations shift, don’t just match wages—match experience. Messaging that emphasizes career paths, flexible scheduling, and guest-impact roles will outperform “fast hire” job ads alone.

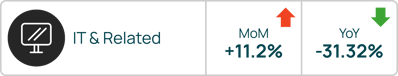

IT & Related

AI and security drive targeted wage inflation—but broader IT hiring remains strategic and selective.

What’s Shaping the Market:

Attraction prices for IT roles jumped +11.2% MoM in June, but are still –31.2% below June 2024, underscoring a market in strategic recalibration—not broad recovery.

- The Information sector added 3,000 jobs in June, while broader tech-adjacent roles (including professional and technical services) saw continued selective growth—driven by demand for AI, cybersecurity, and data infrastructure talent.

- AI and cybersecurity roles are driving growth, with machine learning engineers, prompt engineers, and platform security experts commanding premium compensation.

- Help desk and generalist dev roles are lagging, seeing little movement in attraction prices or hiring velocity.

- Tech unemployment sits at 2.8%, indicating demand remains strong—just narrower and more skills-driven than in prior cycles.

- Compensation bifurcation is widening: employers are paying up for innovation talent while tightening belts on baseline roles.

What This Means for You:

Don’t confuse niche demand with a rising tide. This is a precision market—where targeted investment can yield high ROI, but broad hiring will likely underperform. If you're hiring for AI, data, or security, now is the moment to move aggressively—before salaries rise further. If you're hiring in legacy categories, treat this as a cost-control window. Separate your strategies by role type, and reframe your messaging around impact and autonomy—especially for high-skill talent. The next six months will reward clarity and selectivity far more than volume.

Finance and Operations

Transformation surge is fueling hiring—but structural constraints are emerging.

What’s Shaping the Market:

Finance & Operations is leading the charge, with attraction costs rising sharply amid Q3 planning and digital transformation initiatives.

- Financial activities added ~3,000 jobs in June, steady year‑over‑year but below 2024’s monthly average (~5,000/month), indicating careful expansion rather than broad staffing.

- Pricing dynamics suggest fierce role-level competition: strategic roles (e.g., transformation finance, process automation) saw the steepest cost increases, while traditional accounting or purchasing roles remained stable.

- Automation is reshaping job scopes, increasing demand for analytics-fluent roles that bridge finance and operations—enhancing hiring value but squeezing legacy functions.

- Contractor demand is growing, yet full-time roles still command a premium, especially where long-term systems leadership is needed.

- Economic uncertainty and cost mandates are pushing finance leaders to seek predictive modelers and scenario planners to manage inflation and margin pressure.

What This Means for You:

Act now—this hiring window won’t last. Prioritize roles that offer systems fluency and analytical impact. Bundle roles (e.g., ops + analytics) to signal transformation upside and stand out. If you're filling legacy finance positions, be precise: high-volume spend risks overpaying against rising CPA baselines. Summer 2025 is a moment to secure strategic talent before competition intensifies in Q4.

Transportation & Logistics

Surface stability, structural strain: Wage floors are climbing even as volume plateaus.

Talent attraction prices in Transportation & Logistics dropped 10.3% month-over-month, but prices remain 13% above June 2024—reflecting persistent wage pressure in a market that appears flat but is under real stress.

- Only 7,500 jobs were added in June, mirroring June 2024 and falling below seasonal expectations. But talent attraction prices remain elevated—especially for CDL, last-mile, and warehouse automation roles—where backfill urgency and certification barriers continue to inflate cost-per-acquisition.

- Wage pressure is real and uneven. While national averages rose, we’re seeing hyper-local spikes in intermodal hubs, fulfillment centers, and cross-border lanes. Drivers in constrained markets are commanding 10–15% more than their peers just 12 months ago.

- Tariff impacts and inventory strategy shifts are starting to bifurcate hiring: import-heavy regions are pulling back, while others are ramping up warehouse throughput and rebalancing modal mix to hedge volatility.

- Visa tightening and new CDL requirements are expected to shrink available talent in key corridors by early Q4—particularly in the Southeast and border states—raising concerns about holiday season capacity.

What This Means for You:

Ignore the headline softness—this is a compression market. Prices are already higher YoY, and structural constraints point to further escalation by late summer. If you rely on licensed or skilled logistics labor, use this moment to lock in talent before competition accelerates. Geo-targeting, flexible shift design, and faster onboarding will outperform ad budget alone. The cost floor is rising—get ahead of it while you still can.

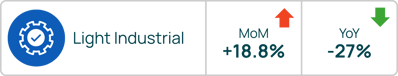

Light Industrial

Prices tick up, but the fundamentals still signal a cautious, capacity-first market.

What’s Shaping the Market:

Light Industrial saw one of the largest month-over-month price jumps in June, up 18.8%, yet pricing remains nearly 27% below where it stood in June 2024. This isn’t a sign of a strong comeback—it’s a signal that employers are selectively reinvesting after months of suppressed demand.

- Hiring volumes remain soft. Manufacturing lost 7,000 jobs in June, and the sector has now shed jobs for most of 2025. The drag is most visible in durable goods and large-scale production, where automation, trade shifts, and energy costs continue to limit headcount expansion.

- Strategic hiring is the new norm. Employers aren’t bringing back full shift lines—they’re adding targeted roles in maintenance, quality control, and cross-functional warehouse support. Flexibility and specialization are outpacing scale.

- Temporary and project-based staffing are filling the gap. Light industrial orgs are leaning into contingent labor to absorb demand spikes without committing to full-time headcount. This is especially true in logistics-adjacent roles like packaging, palletization, and seasonal fulfillment.

- Talent scarcity is creeping back in. Despite overall softness, roles requiring certification (forklift, CNC, welding) remain difficult to fill. Retirements and training lags are tightening certain skill pockets—especially in the Midwest and Southeast.

What This Means for You:

Don’t let the price dip lull you into overconfidence. The market is uneven, and when demand returns—especially in reshoring-aligned regions—competition will escalate fast. Use this window to lock in skilled talent and evaluate your temp-to-perm pipeline strategy. Focus your budget on roles tied to reliability, compliance, and throughput—not just raw output. Summer 2025 is the time to calibrate, not coast.

Food Services

Summer surge masks lingering volatility—volume’s up, but pricing remains tempered.

What’s Shaping the Market:

Attraction prices rose a modest 10.9% in June, but still sit 13.6% below last year’s levels—reflecting a seasonal uptick in staffing demand tempered by cost constraints.

- Hiring picked up modestly, with about 6,500 jobs added in June 2025, compared to a contractual decline of ~3,100 jobs in June 2024, signaling steadier—but still cautious—recovery.

- Cost pressures are limiting wage flexibility. With food-at-home costs up 3.8% YoY and food-away-from-home prices rising 4.2%, operators are facing squeezed margins and limited ability to boost pay.

- The talent pool remains soft: Temporary and student labor is helping fill volume gaps, but turnover is still elevated—suggesting role stability is still a challenge.

- Efficiency trumps premium pay. Operators focused on interview speed, text-to-apply systems, and flexible scheduling are outperforming competitors even without offering higher wages.

What This Means for You:

June’s bump confirms summer demand—but don’t confuse stability for strength. Volume is rising, but so are costs and turnover. Now is the time to optimize your funnel—fast interviews and flexible hours will win more seats than higher pay in many markets. If you’re in metro areas, emphasize career pathways (“where this role leads”) over hourly rate. And don’t wait—top seasonal talent will be off the market by mid-July.

Sales

Demand is sharply rising—driven by Q3 pipeline urgency and pricing pressure across B2B channels.

What’s Shaping the Market:

Sales hiring continues to surge, with attraction prices skyrocketing 78.7% month-over-month and nearly 95% above last July’s baseline. This reflects a dash to fill revenue seats—particularly in SaaS, healthcare solutions, and technology-driven B2B roles—as organizations lock in Q3 growth.

- Hiring volume is picking up steam. While BLS doesn’t isolate sales roles by job category, broader private-sector payrolls added 74,000 jobs in June, with sales roles comprising a growing share. This reflects a strategic shift: companies are front-loading revenue talent over less performance-linked hires.

- Commissions and uncapped upside are driving interest. Job seekers are actively engaging with roles that highlight immediate earning potential. Passive candidate flow is weakening, pushing employers to double down on urgency in messaging.

- Segment-specific targeting is outperforming generic listings. Firms using role-specific funnels for field, inside, and SDR roles are seeing better conversion and shorter time-to-hire, compared to broad-based sales recruitment campaigns.

- Budget discipline is slipping—processes are strained. As teams ramp for Q3, hiring speed often outpaces structured planning, increasing risk of mis-hires or compensation creep.

What This Means for You:

This isn’t a hiring wave—it’s a sprint. If you’ve got quota-driving roles to fill, delay isn’t an option. Shape ads with urgency (“hiring now,” “apply today”) and emphasize uncapped earnings and flexibility. Deploy segmented pipelines (SDR vs. field vs. inside)—generic listings will struggle to keep pace. And if you’re still on fence about volume vs. quality: leaning into speed and clarity now beats expensive corrections later.

Looking Ahead: Labor Market Signals Through Fall 2025

- Hiring Gets Smarter, Not Slower

As economic growth cools, companies are dialing up precision—focusing hiring on strategic roles (AI, finance, logistics) while consolidating legacy headcount. - AI Wage Gaps Widen

Expect continued upward pressure on pay for AI and cybersecurity talent. Premium roles could see another 5–8% hike by year-end as demand outpaces supply. - Seasonal Cycles Shorten

The back-to-school hiring peak will hit in July and fade by mid-August. Hospitality will stay active through early September—but only in high-demand regions. -

Candidate Experience Will Decide Wins

Application flow is slowing. Conversion will depend on fast follow-up, flexible scheduling, and job ads that highlight growth—not just pay.

If you’d like to understand how these trends impact your company, explore our strategic consulting services and connect with one of our experts for a tailored discussion.