The Talivity Talent Market Index offers a fresh perspective on talent supply and demand dynamics across industries. It tracks the fluctuating prices employers pay to attract talent through paid advertising across diverse media channels. Unlike traditional metrics like job openings and hiring volume, the Index reveals nuanced changes in talent demand—delivering early signals even when job volume stays flat.

In this report:

Watch the LinkedIn Live Replay

Key Findings

Labor Market Sharpens, Not Shrinks: Employers Prioritize Precision Over Volume

- 139,000 jobs were added in May, while unemployment held at 4.2%. But with jobless claims up and participation down to 62.4%, signs of softening are emerging—especially in frontline and seasonal hiring.

- The May Talent Market Index shows mixed momentum. Prices rose in 5 of 9 job categories, with sharp surges in Finance & Ops (+89.8%) and IT & Related (+28.9%), signaling a return to growth in strategic functions. Meanwhile, Food Services, Retail, and Hospitality declined—reflecting more cautious spend in consumer-facing roles.

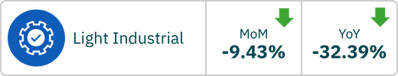

- YoY prices fell in 6 of 9 sectors, most notably Light Industrial (–32.4%) and Food Services (–24.6%), indicating more available talent or more precise targeting by employers.

Segment Analysis

Healthcare

Prices dipped slightly in May, but healthcare remains the highest-cost category, with 62,000 jobs added. Demand is holding steady—especially in nursing, behavioral health, and home care—but labor supply remains a structural constraint.

What’s shaping the market:

- Aging population = rising utilization, especially in outpatient and eldercare settings.

- Immigration slowdowns and visa backlogs are limiting the flow of international nurses and allied health professionals.

- Medicaid funding shifts are squeezing rural and nonprofit systems, creating geographic labor gaps.

What this means for you:

- Use pricing dips to get ahead of summer competition—especially in high-demand regions.

- Invest in community-based sourcing and pipeline partnerships, not just job ads.

- If your footprint includes underserved markets, prepare for incentive fatigue—you’ll need more than sign-on bonuses to stand out.

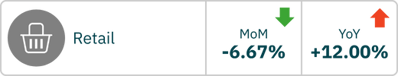

Retail

The retail sector is in retrenchment mode. While prices remain up YoY, hiring demand has softened—64,000 jobs shed so far in 2025. Inflation, tariffs, and shifting consumer behavior are reshaping the hiring playbook.

Key drivers:

- Spending is down in non-essential categories; shoppers are prioritizing value and essentials.

- Tariffs on imported goods are straining margins—especially for apparel and home brands.

- Many retailers are turning to smaller teams, cross-trained roles, and automation in fulfillment and customer service.

What this means for employers:

- Refocus job spend on regions and roles directly tied to near-term revenue (e.g., fulfillment, digital ops).

- Consider reallocating seasonal budgets to candidate experience and training—it may deliver better retention than overspending on clicks.

- Watch back-to-school trends closely. If inventory slows, hiring will too.

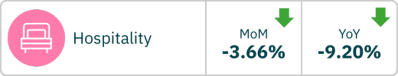

Hospitality

Hiring demand is holding firm, with 48,000 jobs added in May, but attraction prices cooled slightly. That’s not a pullback—it’s a recalibration.

What’s happening:

- Domestic travel demand remains strong, especially in warm-weather and drive-to destinations.

- International travel is softening, with reduced inbound volume and cautious consumer spending.

- Hotel chains and restaurants are balancing labor availability with revenue uncertainty as peak season ramps up.

What this means for you:

- Speed matters—top candidates are getting multiple offers within days.

- Invest in geo-targeted ads and fast hiring funnels in high-demand regions.

- If you’re in luxury or resort markets, raise your wage floors now before late-summer surges make competition even tighter.

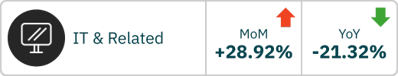

IT & Related

After two months of muted demand, tech hiring saw a sharp rebound in May. This isn't a return to the tech hiring frenzy of the past—but it does point to a more focused wave of investment, particularly in roles tied to AI, data infrastructure, and digital transformation.

What’s driving the shift?

- AI deployment is entering the build phase—and orgs need the talent to support it. We’re seeing increased competition for machine learning engineers, prompt engineers, and data pipeline architects.

- At the same time, hiring for legacy roles like help desk, QA, and frontend dev remains flat or declining—indicating continued consolidation.

- IT budgets are cautiously expanding, with more spend flowing toward automation, cybersecurity, and internal efficiency tools.

What this means for you:

- Prioritize AI-adjacent roles now. Even with prices up MoM, they’re still down YoY—offering a window to build pipeline before demand (and costs) spike again.

- Separate your strategy by job type: pull back spend on declining roles, and amplify your outreach for emerging specialties.

- Optimize your messaging: High-skill tech talent is motivated by purpose, impact, and autonomy. Job ads that speak to innovation and ownership will perform better than laundry lists of tools.

Finance and Operations

The biggest mover this month. After months of slower demand, prices snapped back—suggesting a mix of pent-up demand, end-of-quarter hiring, and increased appetite for strategic talent.

Why the spike?

- Many companies are hiring for finance transformation roles—talent that can model scenarios, manage cost pressure, and help operationalize AI.

- Ops roles are evolving, with more emphasis on automation oversight, systems thinking, and data fluency.

- Contractors and project-based roles are growing, but quality full-time talent is still commanding a premium.

What this means for employers:

- Advertise with role clarity: finance pros want challenge and growth, not just a paycheck.

- Bundle roles creatively (e.g., ops + analytics) to appeal to modern talent expectations.

- Make sure your ad strategy aligns with Q3 planning cycles—this may be your last pricing window before CPA climbs further.

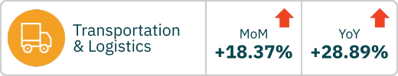

Transportation & Logistics

This sector keeps climbing. Attraction prices jumped MoM, and demand remains strong, with job gains led by warehousing, trucking, and last-mile delivery.

What’s behind it:

- Port activity and inland distribution centers are seeing volume shifts due to tariff changes.

- Immigration constraints continue to limit CDL drivers and skilled logistics workers.

- Delivery expectations are still high—even as volume normalizes—driving pressure on staffing and routing.

- If you’re hiring for licensed roles (CDL, forklift), expect to spend more or move faster—there’s little slack.

- Use retargeting strategies and conversion-focused ads to reduce drop-off in competitive markets.

- For rural or suburban roles, consider widening commute radius or offering flexible shifts to reach passive talent.

Light Industrial

Down sharply YoY, this category is where supply is outpacing demand—but the story is nuanced.

Why it’s softening:

- Automation and robotics are displacing low-skill roles at scale.

- Manufacturing activity has plateaued, particularly in durable goods.

- Employers are more focused on retention and productivity than raw headcount right now.

What this means for you:

- If you’re in high-turnover roles, now’s the time to pilot AI-driven sourcing or scheduling tools—budgets will stretch further.

- Don’t overhire. Use labor index data to calibrate spend by geography—some markets are flooded, others are tight.

-

As reshoring trends pick back up, be ready to pivot quickly—pricing may not stay this low.

Food Services

Prices stayed flat, but food service remains a volatile, high-churn category. May saw 27,000 jobs added, suggesting solid demand—but employers are being more selective.

Context:

- Summer hiring is peaking, with fast-casual and regional chains leading the way.

- Labor availability is improving slightly—thanks to student workers and part-time flexibility.

- Wage floors are holding steady, but rising food and operating costs are capping how much employers can pay.

What this means for you:

- Don’t delay job postings—the best seasonal talent will be off the market by July.

- Use text-to-apply flows and same-day interviews to reduce friction.

- For metro markets, focus on shift flexibility and career path messaging to stand out.

Sales

Sales hiring surged in May—likely tied to Q2 performance pushes and pipeline acceleration. Demand is rising fastest for inside sales, healthcare reps, and SaaS BDRs.

What’s fueling demand:

- Companies are doubling down on revenue roles to meet 2025 growth targets.

- With lower tech CPAs and more available talent, many are taking advantage of lower funnel costs to hire sales talent fast.

- Commission-based roles are seeing the biggest lifts—especially where uncapped earning potential is advertised clearly.

What this means for employers:

- Push urgency in your ads—“we’re hiring now” language converts better mid-year.

- Showcase earning potential and flexibility, not just base salary.

- If you’re in B2B or tech sales, invest in custom landing pages and remarketing to drive conversions.

Looking Ahead: SUMMER SIGNALS TO WATCH

- Macro Caution, Micro Action

Employers are planning with precision. While overall growth slows, targeted investment continues in healthcare, logistics, and emerging tech. - AI Reshapes the Middle

We’re watching the bifurcation of white-collar hiring: legacy roles consolidate while specialized AI and data talent attract premiums. - Seasonal Cycles Intensify

Hospitality and food services will face peak stress tests in June–August. Regional demand may outpace supply in vacation-heavy markets. - Employer Brands Will Matter More

With job seeker sentiment down and applications per job shrinking, standing out to passive talent will depend on strong storytelling and fast follow-through.

If you’d like to understand how these trends impact your company, explore our strategic consulting services and connect with one of our experts for a tailored discussion.