The Recruitics Talent Market Index offers a fresh perspective on industry talent supply and demand dynamics. It tracks the fluctuating prices of attracting talent through paid advertising across diverse media channels. By focusing on pricing data, the Index complements traditional labor market metrics like job openings and hiring volume, providing a more precise signal of demand for talent, regardless of job posting volume.

In this Report:

-

-

- Segment Analysis: Price Declines and Price Increases

- Key Labor Market Divergences

- Segment Analysis: Price Declines and Price Increases

-

August 2024 Key Findings

U.S. Recruitment Costs Show Sharp Divergence Across Industries: Declining Demand in Retail Leads to Lower Talent Attraction Costs, While Hospitality and IT Face Stronger Hiring Competition Amid Economic Shifts.

-

- Overall Trends: Market prices to attract talent continue upward trend year-over-year while month-over-month changes diverge across industries.

- Sector-Specific Insights: The Finance & IT industries are driving up recruitment prices as they increasingly require more specialized expertise. Continued demand for talent in sectors like healthcare and hospitality is also contributing to higher prices.

- Retail Focus: The retail sector has seen a slowdown in hiring demand, leading to a significant drop in recruitment prices as businesses stabilize their workforces. An increase in applicants has further driven down competition for the fewer non-seasonal roles available.

Segment Analysis

Price Declines

Finance & Operations

Recruitment costs for finance and operations fell by 2.20% last month but jumped 48.33% year-over-year. This decline reflects cautious hiring as businesses streamline operations and reduce back-office roles. Despite this, long-term demand remains strong, driven by the need for new technical skills and strategic insight. In 2024, companies are seeking professionals with expertise in data-driven decision-making, regulatory compliance, automation, and sustainability, leading to continued competition for top talent.

Hospitality

The hospitality sector saw a significant 33.80% drop in recruitment costs this month, following a substantial rise over the past year (+223.67%). This sharp decline reflects a stabilization in post-pandemic hiring after a surge in demand for hospitality workers as travel and tourism rebounded. The year-over-year increase indicates that while prices have cooled recently, the sector has significantly recovered, driving long-term demand for service roles.

Retail

Retail recruitment costs dropped dramatically by 40.73% in the past month and are down 56.39% compared to last year. Early holiday hiring has slowed as retailers focus on stabilizing their workforce. Inflationary pressures and fluctuating consumer demand have reduced the need for aggressive hiring in retail, contributing to the sharp decline in recruitment costs, both month-over-month and year-over-year.

Transportation & Logistics

Costs in the transportation and logistics sector fell by 5.07% this month and are down 24.67% compared to last year. The steady decline in recruitment costs reflects the sector's stabilized hiring needs as supply chain disruptions continue to moderate. Although demand for logistics roles remains, employers are cautious, keeping costs from rising significantly.

Light Industrial

The light industrial sector saw a modest decline of 1.06% in recruitment costs this month, while costs have risen 10.63% year-over-year. This reflects the steady demand for workers in manufacturing and related fields, as employers manage operational needs while keeping cost increases minimal.

Price Increases

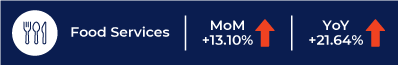

Food Services

Recruitment costs in food services rose by 13.10% this month, reflecting a steady recovery as the industry rebounds from pandemic-related disruptions. The year-over-year increase of 21.64% highlights consistent demand for workers, driven by inflation and consumer behavior changes. Despite some moderation in hiring pace, the sector remains competitive, pushing recruitment costs upward.

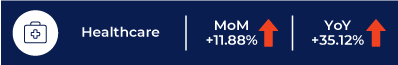

Healthcare

The healthcare sector experienced an 11.88% rise in recruitment costs this month, following a 35.12% increase year-over-year. This reflects ongoing demand for healthcare workers, particularly in hospitals, home healthcare, and nursing facilities. The sector continues to expand, with 55,000 jobs added in July, showcasing its crucial role in the U.S. employment landscape.

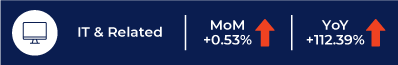

IT & Related

Although IT recruitment costs increased slightly by 0.53% this month, they have surged 112.39% year-over-year. This reflects the continued demand for highly specialized roles in areas like AI, cybersecurity, and cloud computing, even as the broader tech sector experiences hiring slowdowns. Companies are increasingly selective, focusing on critical roles that drive innovation, which has led to elevated long-term recruitment costs.

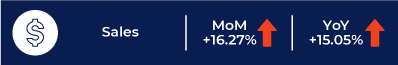

Sales

Sales recruitment costs rose by 16.27% this month, with a 15.05% increase year-over-year. This reflects heightened competition for talent as companies seek to drive revenue in a challenging economic environment. Sales roles remain vital to business growth, leading employers to invest more in attracting and retaining top talent in this field.

Labor Market Divergence in Retail, Food Services, and Hospitality

Talent Market Index for Food Services, Retail, and Hospitality: Retail hiring demand continues to slow, reflected in declining recruitment costs, while food services and hospitality show more consistent trends. Hospitality experiences steady demand with occasional spikes, indicating strong workforce needs. Meanwhile, retail sees fluctuating but overall lower levels of hiring competition, contributing to reduced recruitment costs and a stabilization of the workforce..png?width=701&height=406&name=TMI_Food_Retail_Hosp_V3%20(1).png)

Conclusion

The September release of the Recruitics Talent Market Index highlights the divergent trends across key industries, showcasing a complex and evolving labor market. While sectors like retail experience a cooling in hiring demand, evidenced by significant drops in recruitment costs, industries such as healthcare, IT, and hospitality continue to face strong competition for talent.

This shift underscores the need for specialized skills and strategic insight, particularly in industries navigating rapid technological advancements and regulatory demands. As we move further into 2024, employers will need to adapt their hiring strategies to meet the growing complexities of the labor market while balancing cost efficiencies and talent acquisition.

—

Staying on top of the labor market is essential when creating or revamping recruitment strategies. The talent acquisition experts at Recruitics are here to help you navigate any market condition. We use real-time data to pivot, innovate, and collaborate, aiming to make your approach more precise, intuitive, and efficient. Contact us today!