The Recruitics Talent Market Index offers a fresh perspective on industry talent supply and demand dynamics. It tracks the fluctuating prices of attracting talent through paid advertising across diverse media channels. By focusing on pricing data, the Index complements traditional labor market metrics like job openings and hiring volume, providing a more precise signal of demand for talent, regardless of job posting volume.

In this report:

Watch the LinkedIn Live Replay

January 2025 Key Findings

Talent Market in Flux: Federal Workforce Shift, Rising Talent Attraction Prices, and Sector-Specific Job Trends Define the first month of 2025 Labor Landscape

- Varied job segment demand and higher job seeker interest have led to mostly lower hiring costs month-over-month, except in food service and retail, where costs remain elevated.

- Year-over-year hiring costs remain consistently high, reflecting ongoing labor market tightness in key sectors.

- The influx of federal employees into the private sector could shift labor dynamics, influencing wages, competition, and hiring strategies across industries.

- Job seeker activity has increased YoY, with applications per job rising to 5.1 in January 2025, up from 4.4 in January 2024.

Segment Analysis

Healthcare

Healthcare remains a key driver of job growth, adding 44,000 jobs in January 2025, though down from 70,000 in January 2024. Talent attraction prices fell -4.58% MoM but rose 2.46% YoY, reflecting a more cautious hiring approach. Rising labor costs and wage pressures have made hiring more expensive, leading many facilities to optimize existing staff rather than expand aggressively.

Meanwhile, home healthcare demand is surging, and investments in automation, AI-driven patient care, and telehealth are reducing the need for rapid workforce expansion. As employers balance costs and operational efficiency, healthcare hiring trends will likely remain measured in 2025.

Hospitality

The Hospitality sector saw one of the largest year-over-year price increases, surging +225% YoY, despite a month-over-month decline of -10.26%. Meanwhile, the Leisure and Hospitality sector experienced a slight employment decline, shedding 3,000 jobs in January 2025—a stark contrast to the 11,000 jobs added in January 2024.

The sharp YoY price increase suggests rising demand for hospitality workers, particularly in remote and hard-to-fill locations, such as ski resorts and popular winter travel destinations, where competition for talent remains high. Seasonal demand, coupled with ongoing labor shortages, continues to make staffing these locations a challenge, as employers compete for a limited pool of available workers.

Retail

Retail's post-holiday momentum remains strong, with prices rising both month-over-month and year-over-year. The sector was one of the few to see job growth in January 2025, adding 34,000 jobs—though this was down from 45,000 jobs in January 2024.

In 2024, retail job gains were broad-based across categories. In 2025, however, hiring was concentrated in general merchandise and furniture stores, while electronics and appliance stores saw declines. This shift suggests that consumer spending patterns are evolving, likely influenced by higher interest rates reducing demand for big-ticket items.

Sales

Sales prices have remained relatively flat since Q4 2024, with a nearly 10% YoY decline. On the demand side, the BLS reported that Professional and Business Services—which includes B2B sales, account managers, and sales professionals—added 11,000 jobs in January 2025, a sharp drop from 74,000 jobs added in January 2024.

Historically, organizations scale back sales hiring during economic slowdowns, though the impact varies by industry, company strategy, and the severity of the downturn. In December 2024, job openings in this category declined by 225,000, making January’s modest 11,000 job increase a potential signal that companies are regaining confidence and preparing to invest in sales growth in 2025.

Transportation & Logistics

Transportation & Logistics saw a month-over-month decline of -5.13% but remained up 131.25% year-over-year, signaling a major shift in demand. While seasonal slowdowns likely contributed to the MoM drop, the sharp YoY increase suggests sustained demand for workers in freight, warehousing, and delivery services.

This growth could be driven by ongoing e-commerce expansion, supply chain optimizations, and increased investment in logistics infrastructure. However, with fluctuating fuel costs and evolving automation trends, hiring patterns in this sector may continue to shift throughout 2025.

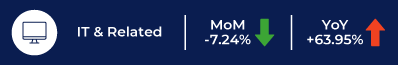

IT & Related

While talent attraction prices in IT & Related declined -7.24% MoM, the 63.95% YoY increase underscores sustained demand for specialized tech talent in AI, cybersecurity, and cloud infrastructure. Despite the month-over-month dip, the strong year-over-year growth signals that companies continue to prioritize critical tech roles that drive digital transformation and innovation.

This trend reflects ongoing investments in enterprise security, automation, and cloud-based solutions, even as organizations navigate cost pressures and evolving workforce strategies.

Light Industrial

Talent attraction prices remained steady month-over-month, with modest year-over-year growth reflecting stable demand for roles in manufacturing, assembly, and warehousing as the sector maintains steady recovery post-pandemic.

Finance & Operations

The year-over-year growth in talent attraction prices for finance and operations roles underscores a robust demand for expertise in managing budgets, optimizing workflows, and ensuring business continuity amid evolving economic conditions.

The Impact of Federal Workers Entering the Private Sector: A Key Shift in the Labor Market

One of the most significant labor market shifts unfolding today is the influx of federal workers into the private sector due to government job eliminations and buyouts. With the federal government being the largest employer in the U.S.—excluding the Postal Service, it accounts for over 2.4 million employees—this transition could have material implications across various industries.

As thousands of federal employees exit public service, certain job segments will see an increased supply of highly specialized talent, influencing wages, hiring competition, and workforce trends.

Where Will Federal Workers Go?

Federal employees primarily work in highly regulated industries and specialized fields, making their transition into private-sector counterparts relatively direct. The sectors most likely to absorb these workers include:

- Aerospace & Defense – High security clearance roles remain in demand.

- Cybersecurity & IT – Federal IT professionals with expertise in government systems and cyber defense are attractive to private firms.

- Government Contracting – Many federal workers will transition into private firms that work directly with the government.

- Finance, Legal, and Accounting – Given their strong representation in the federal workforce, these roles could see increased candidate supply.

How Will This Shift Affect Talent Market Trends?

This new wave of federal workers entering the labor market could drive workforce appreciation in specialized fields but also lead to price corrections as talent supply increases.

- Wages May Soften: With more federal workers seeking private-sector jobs, companies may see reduced hiring costs in high-supply segments.

- Hiring Prices Could Normalize: Sectors like IT & Related (currently up 63.95% YoY in attraction costs) and Finance & Operations (up 21.79% YoY) may stabilize as labor supply increases.

- Elevated Unemployment Rate: With an influx of highly skilled federal workers entering the private sector, competition for jobs—especially in specialized fields like IT, finance, and legal—could intensify, making it even more challenging for existing job seekers to secure roles and negotiate higher wages.

—

If you’d like to understand how these trends impact your company, explore our strategic consulting services and connect with one of our experts for a tailored discussion.

.png?width=654&height=505&name=Map_graph_Feb%20(1).png)