The Recruitics Talent Market Index offers a fresh perspective on industry talent supply and demand dynamics. It tracks the fluctuating prices of attracting talent through paid advertising across diverse media channels. By focusing on pricing data, the Index complements traditional labor market metrics like job openings and hiring volume, providing a more precise signal of demand for talent, regardless of job posting volume.

In this report:

Watch the LinkedIn Live Replay

March 2025 Key Findings

When Economic Signals Collide with Hiring Strategy

Tariffs. Sentiment drops. Federal layoffs. And yet—March delivered 228,000 new jobs and brought more workers back into the labor force. New Talent Market Index Data Shows Employers Playing the Long Game.

- The labor market remains stable—but dynamic. This month’s Talent Market Index reveals a market holding its ground while shifting beneath the surface, reflecting a core contradiction between strong job growth and underlying volatility.

- Despite economic uncertainty, most employers are adjusting, not retreating—playing the long game in workforce planning while bracing for what’s next.

- The Index reveals a wide divergence in month-over-month (MoM) and year-over-year (YoY) movement across sectors, suggesting uneven recalibration across the labor market.

- Sectors like Healthcare, Transportation, and Finance & Ops remain elevated compared to 2024—facing persistent cost pressures tied to talent shortages, policy shifts, and rising demand.

Segment Analysis

Healthcare

Healthcare saw a 5.7% month-over-month decline but remains 14.07% higher year-over-year. Despite the modest dip, persistent demand and limited supply continue to drive up talent attraction prices..

Ongoing immigration constraints and burnout are restricting talent availability. At the same time, the sector continues to lead U.S. job growth—driven by an aging population, increased healthcare spending, and expanded insurance coverage.

With no immediate relief on the supply side, elevated recruitment difficulty and prices will likely persist throughout 2025.

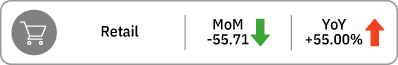

Retail

After a strong start to the year, Retail CPA dropped 55.7% in March, reflecting a seasonal recalibration in hiring activity. While recruitment advertising prices declined sharply month-over-month, they remain 55% higher than the same time last year, signaling ongoing competitiveness in the sector.

According to the BLS Jobs Report, the retail sector added 24,000 jobs in March 2025, slightly outpacing March 2024’s gain of 18,000. This followed a mixed start to the quarter: January added 34,000 jobs, while February saw a decline of 6,000, pointing to short-term shifts rather than structural softening.

The divergence between job volume and cost suggests employers are modulating spend in response to dynamic market conditions. With wage expectations rising, consumer behavior evolving, and staffing models shifting, retail hiring remains active—but more measured—as we head deeper into Q2.

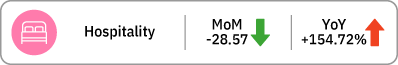

Hospitality

The Hospitality sector continues to face elevated competition for talent, even as talent attraction prices declined 28.6% month-over-month in March. Despite the drop, prices remain 154.7% higher than the same time last year, indicating sustained cost pressure in sourcing service and hourly workers.

According to the BLS Jobs Report, the leisure and hospitality sector added 43,000 jobs in March 2025, up from 29,000 in March 2024. This growth reflects strong consumer demand for travel, dining, and entertainment as seasonal activity picks up.

The combination of robust hiring and persistently high year-over-year talent attraction prices suggests that while employers may be adjusting spend in the short term, competition for talent in hospitality remains intense. Employers should be prepared for continued pricing volatility and regional labor supply constraints as the industry moves toward peak summer hiring.

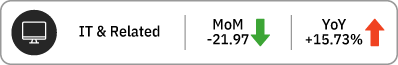

IT & Related

Talent attraction prices for IT & related roles dropped in March. While this represents a notable short-term shift, prices remain 15.7% higher year-over-year, indicating that competition for qualified tech talent hasn’t disappeared—just evolved.

According to the BLS Jobs Report, the Information sector added 3,000 jobs in March 2025, a turnaround from job losses in March 2024. Meanwhile, Professional and Technical Services—home to many IT roles—added 28,000 jobs, slightly up from the same period last year. These gains suggest that demand for digital and technical talent remains steady, even as employers moderate spend on recruitment.

The recent price drop may reflect strategic hiring slowdowns, increased reliance on contract roles, or greater scrutiny on tech investments—not necessarily a retreat from digital initiatives. As companies balance innovation with cost control, recruitment in this category may continue to show monthly variability.

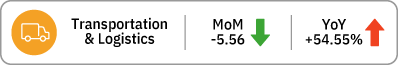

Transportation & Logistics

Talent attraction prices in Transportation & Logistics declined 5.6% month-over-month in March, but remained 54.6% higher than the same time last year, pointing to persistent structural cost pressures in the sector.

According to the BLS Jobs Report, the sector added 36,000 jobs in March 2025, compared to a gain of 23,000 in March 2024, signaling steady demand for workers across freight, warehousing, delivery, and supply chain operations. Despite gains in automation and route optimization, demand for licensed drivers, warehouse associates, and last-mile delivery personnel remains strong.

Looking ahead, tariff policy changes may further influence the sector, as increased import prices could shift inventory strategies and prompt companies to shorten supply chains. In parallel, tight immigration enforcement—particularly in roles historically relying on immigrant labor—could constrain talent pipelines and drive wage pressure.

While short-term prices dipped in March, the year-over-year spike in prices suggests that employers are still navigating a constrained labor market and are competing aggressively for essential logistics talent.

Light Industrial

Talent attraction prices for Light Industrial roles dropped 19% month-over-month in March, and are now 31% lower than the same time last year—marking one of the sharpest declines across all sectors in the Talent Market Index this month.

This shift suggests a notable cooling in employer demand or improved applicant availability, particularly in warehousing, production, and general labor roles. However, the BLS Jobs Report still shows modest hiring activity, with 8,000 manufacturing jobs added in March 2025, up from a loss of 1,000 jobs in March 2024. This signals that while recruitment prices are easing, underlying labor needs have not disappeared.

Looking forward, tariff-related uncertainty could further impact the sector, as employers reassess supply chain strategies and domestic production capacity. If trade restrictions accelerate reshoring, demand for skilled light industrial labor could rebound quickly—potentially pushing talent attraction prices back up in select markets.

Food Services

Talent attraction prices in Food Services held steady in March, with a negligible 0.5% month-over-month change, but are down 25.8% year-over-year—the largest YoY decrease among all sectors in the Talent Market Index.

According to the BLS Jobs Report, the food services and drinking places category added 27,000 jobs in March 2025, following consistent gains throughout the first quarter. That compares to a 22,000-job increase in March 2024, signaling gradual but sustained demand as consumers return to in-person dining.

The decline in recruitment advertising prices may point to improved labor availability, particularly among part-time and entry-level roles, or a stabilization in employer demand after years of volatility. However, wage competition and retention challenges remain high, especially in urban markets and for high-volume employers.

Looking ahead, immigration policy changes could impact the sector’s future labor supply, as many food service roles have historically relied on immigrant workers. While talent attraction prices are trending down, pressure on staffing and scheduling remains a risk, especially heading into peak summer dining season.

Looking Ahead: What to Watch

in Q2

-

Tariff Talk Turns to Talent Talk: Rising trade pressures could dampen business investment, first hitting sectors like manufacturing and logistics. In response, employers may slow hiring or shift to short-term or part-time roles.

-

Confidence Drops = Choice Delays: Lower consumer and job seeker sentiment may drive more passive job searching, making recruitment marketing and brand storytelling even more essential.

-

Healthcare Will Stay Hot: Immigration policy and persistent shortages will likely keep CPA high through the summer. Expect to see creative sourcing and retention strategies come into play.

-

Hospitality’s Summer Test: The next 90 days will reveal whether Hospitality’s hiring prices stabilize—or surge again as vacation season heats up.

---

If you’d like to understand how these trends impact your company, explore our strategic consulting services and connect with one of our experts for a tailored discussion.