The Recruitics Talent Market Index offers a fresh perspective on industry talent supply and demand dynamics. It tracks the fluctuating prices of attracting talent through paid advertising across diverse media channels. By focusing on pricing data, the Index complements traditional labor market metrics like job openings and hiring volume, providing a more precise signal of demand for talent, regardless of job posting volume.

In this Report:

-

-

- Segment Analysis: Price Increases and Price Declines

- 2024 Holiday Hiring Season Update

-

Watch the LinkedIn Live Replay

November 2024 Key Findings

Retail Rebounds After Black Friday Boom, Hospitality Heats Up for Winter, and Recruitment Prices Climb Across Sectors

-

-

-

- Retail Resurgence: Recruitment prices in the retail sector surged driven by strong Black Friday sales and increased demand for seasonal talent during the holiday shopping season.

- Hospitality Heating Up: Hospitality recruitment prices soared month-over-month and year-over-year, reflecting a robust recovery fueled by seasonal travel and leisure activity as winter approaches.

- Broad Market Increases: Recruitment prices rose across nearly all sectors, showcasing intensified competition for talent in key industries.

-

-

Segment Analysis

Price Increases

Hospitality

Talent attraction prices in the hospitality sector increased by a remarkable 92% month-over-month and an even more dramatic 264% year-over-year. This sharp growth reflects surging hiring activity driven by seasonal travel demand and the broader recovery of the leisure and hospitality industry. The Bureau of Labor Statistics reported that leisure and hospitality added 53,000 jobs in November, underscoring the sector's continued rebound.

Retail

Retail talent attraction prices jumped 69% month-over-month and 105% year-over-year, driven by aggressive seasonal hiring as retailers ramped up their efforts to secure talent for the holiday shopping season. Despite a tighter labor market, rising competition among employers pushed prices significantly higher, reflecting the urgency to fill key roles.

Transportation & Logistics

Prices in the transportation and logistics sector increased by 8.79% month-over-month and 50% year-over-year. This growth aligns with heightened demand for supply chain and logistics roles to support holiday fulfillment, bolstered by the continued expansion of e-commerce.

Healthcare

Talent attraction prices for healthcare roles decreased by 4.62% month-over-month and 14.29% year-over-year. Demand for healthcare professionals remains steady. In November, nonfarm payroll growth was largely supported by healthcare, which added 54,000 jobs, this sector continues to face consistent hiring pressures.

Sales

Sales recruitment prices grew by 8.33% month-over-month and 10.17% year-over-year. The month-over-month rise signals increased focus on revenue-generating positions as businesses strengthen their sales teams heading into Q4 and prepare for year-end revenue pushes.

Light Industrial

Talent attraction prices in the light industrial sector increased by 6.94% month-over-month but declined 2.53% year-over-year. This suggests stable hiring trends, with slight monthly adjustments to meet operational needs as demand normalizes.

Finance & Operations

Recruitment prices for finance and operations roles increased 1.06% month-over-month and 3.23% year-over-year, indicating steady demand for professionals in these areas. Businesses remain focused on efficiency, compliance, and financial health, driving modest but consistent hiring activity.

Food Services

The food services sector saw a 3.85% month-over-month increase, though prices are down 34.15% year-over-year. The modest monthly rise reflects seasonal trends, while the year-over-year decline indicates eased hiring pressures as more workers re-enter the market for in-person roles.

Price Declines

IT & Related

Recruitment prices in the IT sector declined by 3.18% month-over-month but remained up 85.37% year-over-year. This reflects stabilization in hiring after sustained growth earlier in the year, with demand still strong for roles in digital transformation, cybersecurity, and AI.

After Black Friday: 2024 Holiday Hiring Season Update

Projected Demand

The 2024 holiday shopping season began with cautious expectations. In the November Talent Market Index release, holiday hiring projections were down year-over-year, reflecting weaker sales forecasts and cautious consumer spending. Retailers anticipated the need for fewer seasonal hires compared to 2023. A few factors impacting this projection are shifts in consumer behavior and shortened holiday shopping window between Thanksgiving and Christmas, which included five fewer shopping days. However, these projections underestimated demand in key areas, particularly in logistics and e-commerce fulfillment.

BLS November Jobs Report

Despite robust consumer activity, the Bureau of Labor Statistics (BLS) reported a loss of 28,000 jobs in the retail sector in November. This decline signals structural challenges in aligning talent acquisition strategies with consumer behavior shifts. Retailers faced increased competition for logistics talent to support growing online sales, while physical retail hiring lagged. Aggressive spending to meet higher-than-expected demand underscored inefficiencies in hiring strategies, revealing the need for more targeted recruitment processes.

Black Friday In-Store Trends

One significant shift this season, driven by a shorter shopping window and increased focus on e-commerce, was the earlier start of Black Friday promotions. Major retailers like Amazon, Best Buy, and Target launched deals as early as November 8, encouraging shoppers to spread out their purchases. This strategy reduced the urgency of traditional in-store Black Friday shopping and extended the holiday buying period.

Despite this, shopper turnout exceeded expectations. According to the National Retail Federation (NRF), approximately 197 million Americans shopped over the five days from Thanksgiving through Cyber Monday, surpassing projections.

While foot traffic to brick-and-mortar stores showed slight improvement, Black Friday in-store sales grew by a modest 0.7% year-over-year, according to Mastercard SpendingPulse. This small gain underscores the enduring shift toward online shopping, even as retailers implemented early promotions and deals to drive in-person visits.

Black Friday & Cyber Monday Online Sales

Online sales continued to dominate the holiday shopping period. U.S. online Black Friday sales reached $10.8 billion, marking a 10.2% year-over-year increase and surpassing analysts’ expectations. Cyber Monday followed suit with $13.2 billion in spending, a 6.1% increase year-over-year. Shopify merchants achieved a record-breaking $4.1 billion in sales on Black Friday, a 22% year-over-year jump, while Walmart reported a 27% increase in e-commerce sales.

These results highlight the sustained growth of digital shopping channels and reflect changing consumer habits, with 71% of shoppers planning to make purchases online during Black Friday compared to just 23% favoring physical stores.

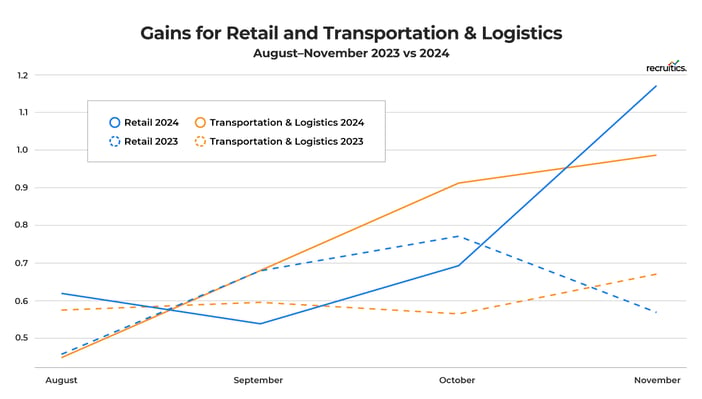

Impact on Latent Seasonality and Talent Acquisition Prices for Retail, Transportation & Logistics

The significant growth in online sales drove heightened demand for logistics and fulfillment talent in Transportation & Logistics, where hiring spiked to meet delivery timelines and rising e-commerce orders. As Black Friday and Cyber Monday sales exceeded expectations, latent demand for seasonal talent emerged, further increasing competition and talent acquisition costs.

In the retail sector, while in-store foot traffic improved modestly, the need for in-person seasonal hires remained lower than expected. Conversely, retailers faced challenges filling logistics roles, reflecting a misalignment between structural workforce needs and the available talent pool. This dynamic highlights the continued seasonal pressures on retail and logistics recruitment.

Looking Ahead

The 2024 holiday season underscores the critical role of e-commerce in driving retail performance. Retailers must refine their hiring strategies to balance the dual demands of online and in-store operations, with a sharper focus on logistics and fulfillment talent. Moving forward, addressing inefficiencies in talent acquisition processes and adapting to evolving consumer preferences will be essential for success. As the labor market tightens, competition for skilled seasonal talent will remain a significant challenge, emphasizing the need for proactive and agile recruitment strategies.

—

Staying on top of the labor market is essential when creating or revamping recruitment strategies. The talent acquisition experts at Recruitics are here to help you navigate any market condition. We use real-time data to pivot, innovate, and collaborate, aiming to make your approach more precise, intuitive, and efficient. Contact us today!