January Bureau of Labor Statistics Highlights

Job Gains

January job gains were much higher than economist estimates, coming in at 353,000 jobs added for the month. Revisions for November and December were also posted, showing that 126,000 jobs were added as 2023 finished strong.

The most exciting part of the job additions was that most sectors saw a bump – compared to what has been seen over the last few months, where the majority of the job gains were in only a few sectors (education and health, government, and professional business services). Healthcare still shows impressive growth, which will likely continue as the U.S. population ages and demand for services soars.

Chart Source: Bureau of Labor Statistics

The strength of the jobs report this month will have an impact on Fed decision-making. While the Fed is projected to decrease rates several times in 2024, economists predict they will not be in any hurry to do so – especially after January came in stronger than anticipated.

Labor Force Participation

Payroll growth shows gains in January were fueled by women to the tune of 198,000, compared to only 155,000 for men. The female labor force participation rate climbed up .4 percentage points (58.4% to 58.8%).

Unemployment also held steady at 3.7%, continuing the record-long streak of remaining under 4%, though most economists predict it will rise to over 4% by the end of 2024. This month marks 26 consecutive months under 4%.

While unemployment held steady this month, the hours worked on average fell to 34.1 hours per week, the lowest seen since 2010 if excluding the COVID-19 recession. Economists claim the reduction in hours could be due simply to January winter storms, or it might also be driven by companies aiming to reduce hours before cutting workers completely.

The share of workers employed part-time for economic reasons also continued to rise this past month; this could be an indication of employers' hesitancy to expand their headcount too much.

Wages

Upticks in wage growth were observed in January, which will also impact decisions made by the Fed on when to cut interest rates. Average hourly earnings were up 0.6% from the prior month, double the average estimate, and rose 4.5% from the prior year.

While wage growth has been observed, the year-over-year change in pay for workers that stay in a job versus change jobs, as reported by ADP, continues to narrow – giving employers more of the upper hand when it comes to salary negotiations.

Chart Source: ADP Research Institute

Job Seeker Sentiment and Intent

The ADP Research Institute’s Employee Motivation & Commitment Index, which measures if employees are flourishing or detaching from their jobs, fell in January. During the same time, layoffs ticked up – a massive 136% since December, though most of those cuts are isolated to a few industries. According to Challenger, Gray & Christmas, the layoffs seen in January of this year are the highest the economy has seen since in the month of January since 2009.

There was also a big increase in discouraged workers in January, which can be defined as those who do not believe there is a job out there for them. An increase of over 100,000 was reported month over month.

Chart Source: ADP Employee Motivation and Commitment Index

It will be interesting to see how job seeker confidence evolves over the course of the year. Zip Recruiter’s last update on confidence showed that it held steady throughout 2023. Year over year, job seekers feel more confident about searching for a job, more confident about the overall labor market, and also more confident in their finances than they did this time last year.

And if looking at how that confidence can translate into intent in 2024, LinkedIn’s latest Workforce Confidence Index survey found that nearly half of U.S. workers in several industries have said they plan to look for a new job in 2024. Percentages vary by industry, but retail and hospitality top the list.

To summarize January’s labor market update, the economy is stronger than expected. January’s report will complicate next steps for Fed decision-making on interest rates as job growth and wages remain strong. The labor market is still tight, with more openings than there are people to fill the roles. Recruiting in 2024 may not be as intense as it’s been in the past few years, but it will still be difficult to fill openings – particularly in areas with gaps in the skills needed to fill the openings.

Industry Spotlight: Healthcare, Registered Nurses

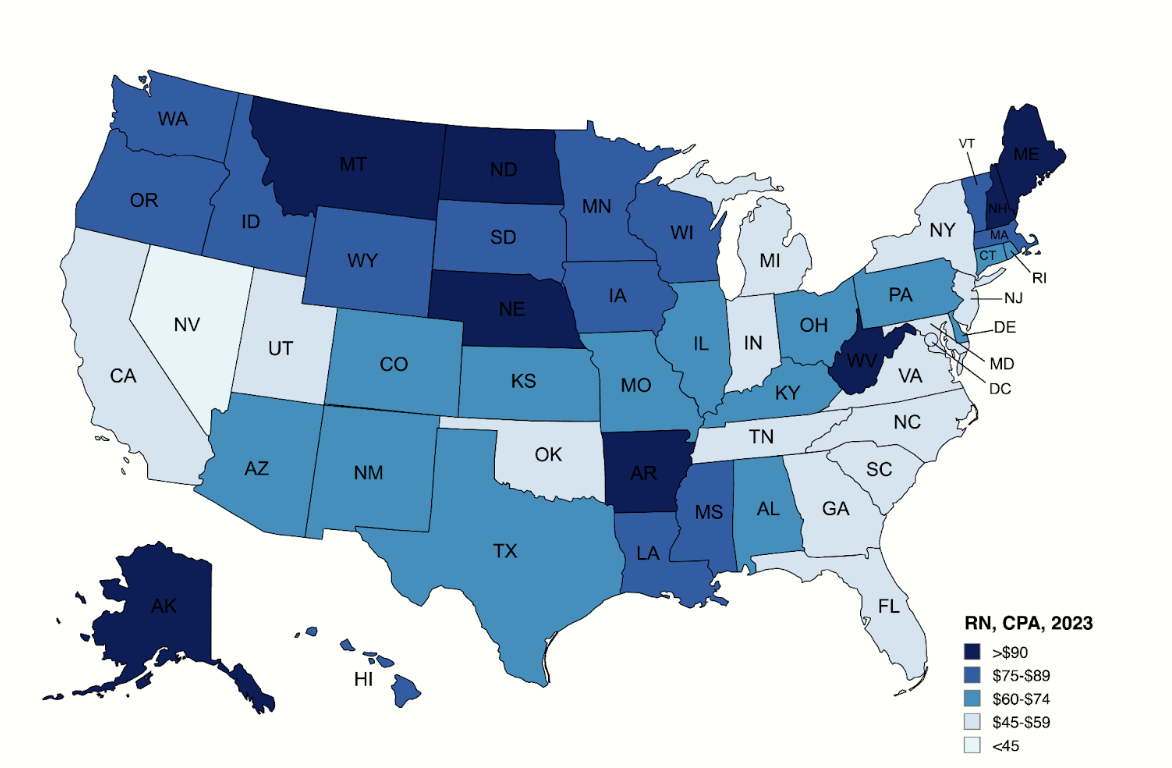

According to Recruitics data, the CPAs for RN’s remain elevated above most other role types, given the continued increase in demand for nurses in the U.S. The chart below shows a few states with CPAs over $90, with the most significant percentage of states hovering between $60 and $74 dollars in 2023.

Chart Source: Recruitics Analytics

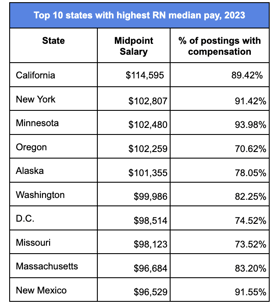

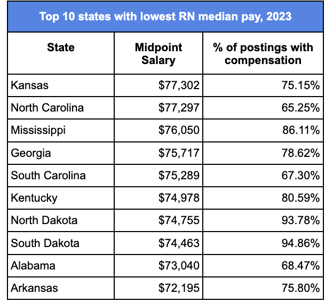

Wages, as reported in job advertisements on Indeed, also vary by state. The chart below shows the top 10 states with the highest pay rates in 2023 and the top 10 states with the lowest pay rates for the year. Also included is the percentage of postings within each state that include compensation rates for registered nurse jobs.

On average, 82.85% of job ads included salary in the posting for the states with the highest median salaries, versus only 78.59% of ads for the bottom 10 paying states.

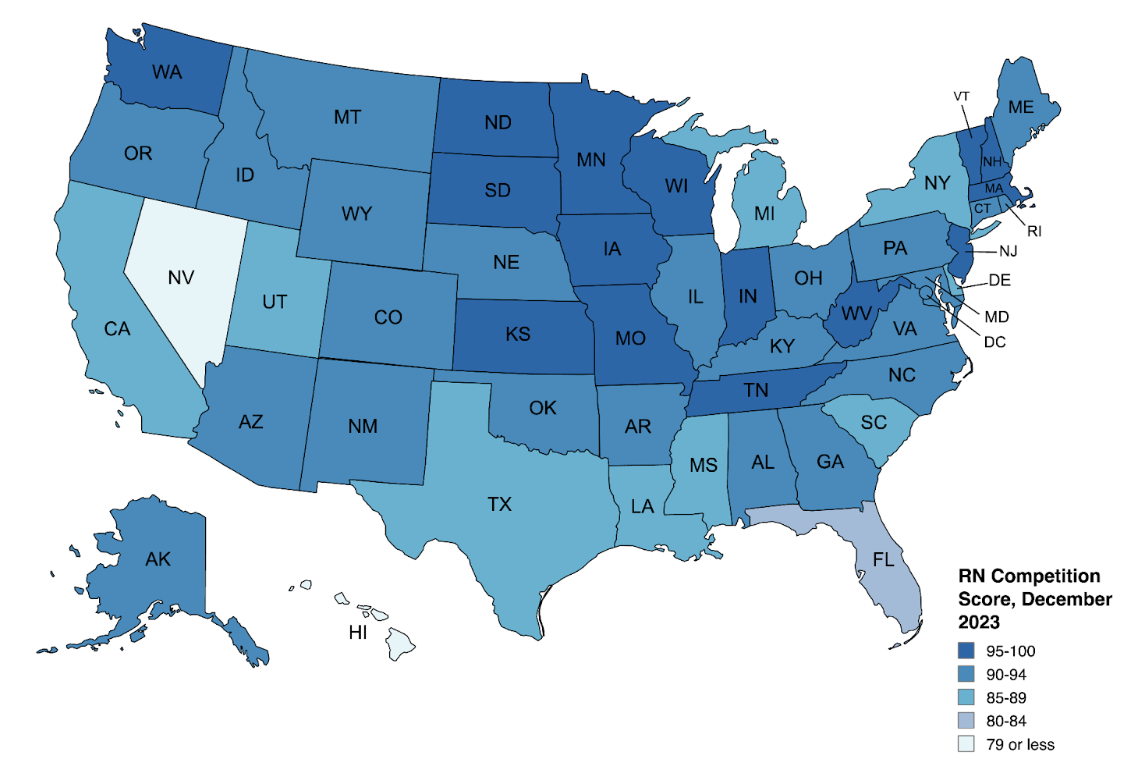

Lastly, below is a chart showing competition for nurses nationwide at the close of 2023, as reported by Indeed Hiring Insights. Hiring for nurses is and will remain very competitive for most of the country as demand soars and supply cannot keep up.

If comparing January of last year to December, competition increased in all but five states. In this instance, competition is measured by the job seekers available per job. And interestingly, eight of the states where pay was the lowest in 2023 ranked 90 or above in competition score.

Chart Source: Indeed Hiring Insights

—-

Staying on top of the labor market is essential when creating and pivoting recruitment strategies. The talent acquisition experts at Recruitics are here to help ensure you are able to navigate any market condition. We utilize real-time data to pivot, innovate, and collaborate, aiming to make your approach more precise, intuitive, and efficient. Contact us today!