Key Takeaways:

- March marks three months of consistent job gains, indicating a healthy job market in the U.S. for the first quarter of 2024.

- The unemployment rate for African Americans is on the rise in 2024, increasing from 5.6% in February to 6.4% in March.

- While the job market showed positive signs in March, the number of Glassdoor reviews mentioning layoffs increased by 28% year over year.

The job market shows no signs of cooling, with 303,000 jobs added in March.

The job market remains hot as employers added 303,000 jobs in March, according to the latest BLS report. March marks three months of consistent job gains for nonfarm payroll employment, indicating a positive sign for the U.S. economy in 2024. Several industries had double-digit month-over-month gains, with healthcare seeing an 88% increase and almost doubling in February. And even with higher costs for materials, construction added 8,211 jobs in March. The continued strength of the job market will likely cause the Fed to take a cautious approach to rate changes, as many economists indicate.

Chart Source: Bureau of Labor Statistics

Unemployment dips slightly, though African American unemployment is increasing.

Unemployment ticked down to 3.8% in March. While it has seen small monthly fluctuations, this rate has remained relatively steady since August 2023. When it comes to unemployment by race, the rate for African Americans has been on the rise since January of this year and is now above 6%. The last time unemployment for African Americans reached this level was in June 2023, before declining in the year's back half.

Employees are more committed to their jobs than they have been in the last 12 months.

According to ADP Research Institute’s Employee Motivation & Commitment Index, employee sentiment for the first quarter of 2024 was high. Heading into the second quarter, employees are more committed to their jobs and are motivated to stay, suggesting that employers will need to work harder to get candidates to switch jobs.

It is also worth mentioning that Glassdoor reports a 28% year-over-year rise in reviews that mention layoffs in March. Despite the positive trends observed in overall job growth and unemployment rates, there is an underlying sense of anxiety around layoffs that is also top of mind across the workforce.

Industry Spotlight: Retail

Below are insights into retail's expected growth in 2024, trends in job openings and quits over time, sentiment from employees over the last 12 months, and some tips for things to do now to prepare for peak hiring season.

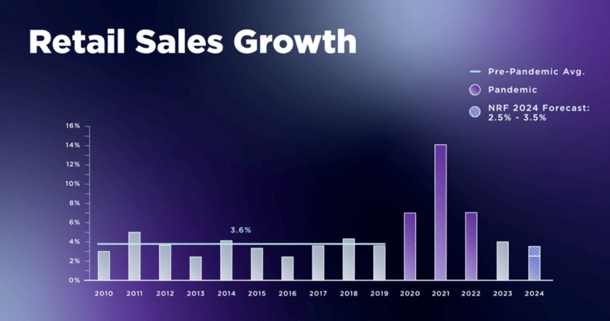

Sales growth is back to pre-pandemic levels.

Late last month, the NRF shared the latest forecasted sales growth for the retail sector. The forecast suggests that retail sales will increase in 2024 between 2.5% and 3.5% to between $5.23 trillion and $5.28 trillion. The 2024 forecast, as seen in the chart below, aligns with the 10-year pre-pandemic average annual sales growth of 3.6%.

Chart Source: National Retail Federation

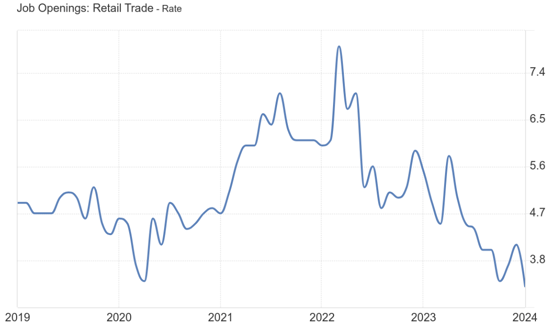

Although sales are forecasted to increase, it's evident that job vacancies in 2024 are notably lower compared to the preceding years. In fact, the job opening rate was lower in January 2024 than it was at the lowest point in 2020, which was 3.4 in April, according to the data below from the Federal Reserve of St. Louis. Fewer openings are not only isolated to retail but are also seen across other industries – which can indicate a cooling labor market. With the pace of the economy slowing in 2024, the NRF expects about 100,000 fewer jobs on average per month compared with 2023.

Chart Source: Trading Economics, Federal Reserve of St. Louis

Another macro trend to look at is quit rates. Though quit rates for retail are still higher than the total for all jobs, the rates are coming down, and the lines between the two are moving closer and closer together. In January 2024, as depicted in the chart below, quits for retail were at 2.3, compared to 2.1 for all non-farm jobs. Quit rates have not been this low since April 2020, and before that, not since December 2013.

Chart Source: Federal Reserve of St. Louis, Bureau of Labor Statistics

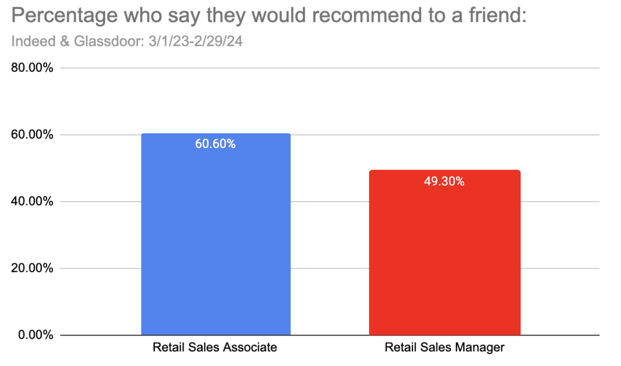

Almost 10,000 reviews were left on Glassdoor and Indeed over the last 12 months across retail sales associate and retail sales manager job categories. Below is aggregated data for Retail Sales Associates compared to Retail Sales Managers across both platforms. Overall scores, as well as scores within the category of “balance,” were notably higher for associates versus managers. Conversely, managers felt better about their job security and pay.

Souce: Aggregated Indeed and Glassdoor Reviews

Along with sentiment by category, another metric Indeed and Glassdoor capture as part of their review process is whether or not an employee would recommend their workplace to a friend. Interestingly, retail managers are less likely to recommend their job than retail associates, according to the reviews captured. This may be due to the high levels of burnout that retail managers face. Retail managers have a lot on their plates. According to Teal, they often work long and unconventional hours, navigate complex staffing challenges, and handle customer escalations while balancing many other things like answering emails. These challenges are frequently exacerbated by peak season, when managers experience even less balance.

Source: Aggregated Indeed and Glassdoor Reviews

When analyzing the actual words used in the reviews that employees left on Indeed and Glassdoor, the terms with the most common negative connotations were “staffed” (100% negative, with references to short-staffed), communication (80% negative, with references to poor and lacking), and customers (56% negative, with references to them being rude, difficult, and bad).

On the positive side, employees most commonly reference their discount and their team of coworkers or people as great things about their job. In fact, for all references of the word “team,” 99% were positive and 100% of references to coworkers were also positive.

Seasonal hiring continues to evolve.

According to Checkr, retail jobs are still taking longer to fill than prior to the pandemic. So, it’s essential to plan early. In their 2023 holiday hiring report, Snagajob reported that most seekers begin looking for a seasonal job around September. To stay ahead of the curve, it is recommended that the hiring strategy be mapped out by July or August. Stay tuned for an upcoming Recruitics blog focused on preparing for peak-season hiring.

—

Staying on top of the labor market is essential when creating and pivoting recruitment strategies. The talent acquisition experts at Recruitics are here to help ensure you are able to navigate any market condition. We utilize real-time data to pivot, innovate, and collaborate, aiming to make your approach more precise, intuitive, and efficient. Contact us today!