2019’s Recruitment Acquisition Craze Has Validated Programmatic Technology and Propelled Adoptions as What Was Once a Trend Becomes a Movement

The weather might be cold now, but 2019 had some of the hottest months in programmatic job advertising history. In fact, we saw 5 major industry acquisitions in July alone! From StepStone’s acquisition of Appcast to our acquisition of KRT Marketing, I asked TA experts what these massive shifts mean for the recruitment industry and programmatic technology’s future.

Before I address the predictions, let’s take a step back a few months to when this acquisition earthquake shook up recruitment as we know it.

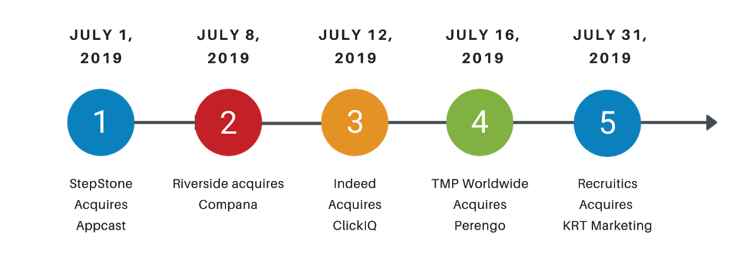

5 Programmatic Job Advertising Acquisitions in July 2019

- July 1, 2019 - StepStone acquired Appcast as the first of five programmatic acquisitions in four weeks! Many wondered what this meant for the future of recruiting.

- Jul 8, 2019 - Riverside acquired Compana as their own programmatic platform. This smaller UK-based company’s news slipped under the radar for most, but their acquisition marked a growing trend in the programmatic job advertising industry.

- July 12, 2019 - Indeed’s acquisition of ClickIQ marked an increasing pattern of companies investing in programmatic technology.

- July 16, 2019 - TMP Worldwide acquired Perengo as their own programmatic technology, and it became clear that programmatic had become a sought after commodity for agencies.

- July 31, 2019 - Recruitics’ acquisition of KRT Marketing became the fifth acquisition in four weeks! Typically, we see agencies acquire technology companies; whereas in our case, Recruitics (both a technology company and an agency) acquired another agency.

What Does This Mean for The Future of Programmatic Job Advertising?

Validation of Programmatic in Recruitment

Heading into 2020, there are five new talent acquisition companies with programmatic software—a huge leap from 2012 when Recruitics started the trend! Recruitics was the first in the industry to pioneer programmatic technology, and it’s amazing to see how far the movement has come. These facts confirm that programmatic job advertising platforms are now a leading technology sought after by recruitment industry leaders.

Chris Forman, Founder & CEO of Appcast says, “Indeed, TMP, and StepStone buying their own programmatic platforms means the 'trend' which started in 2013 is now a movement. You have the largest job aggregator in the world, the biggest global recruitment ad agency, and the #1 jobs classified business in EMEA all making bets.”

Chris Forman, Founder & CEO of Appcast says, “Indeed, TMP, and StepStone buying their own programmatic platforms means the 'trend' which started in 2013 is now a movement. You have the largest job aggregator in the world, the biggest global recruitment ad agency, and the #1 jobs classified business in EMEA all making bets.”

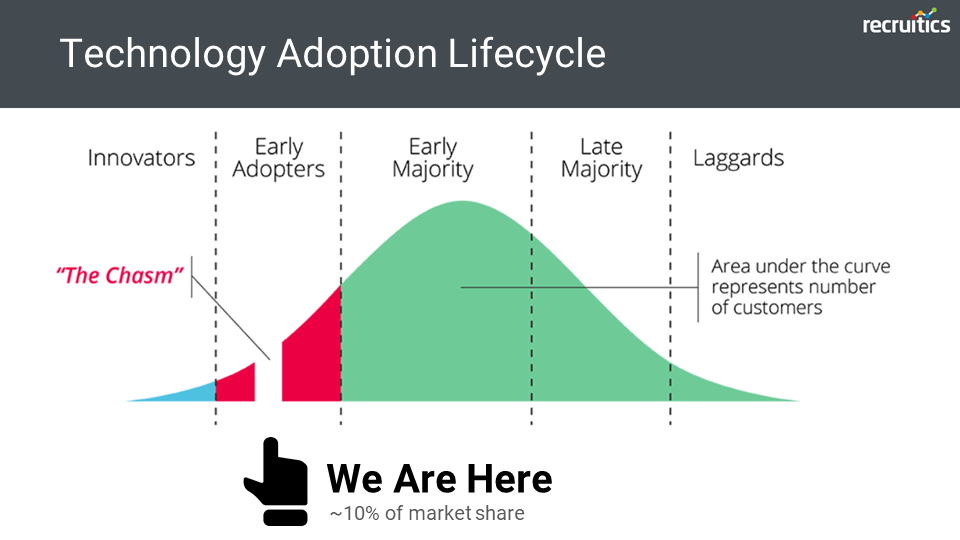

Programmatic’s growth can also be seen via the Technology Adoption Lifecycle:

Currently, programmatic job advertising accounts for about 10% of the market share of all advertising spend in the talent acquisition industry, meaning its in the Early Adopters phase of technology adoption. This acquisition movement has propelled programmatic adoption safely across “The Chasm” that many early adopters fall into.

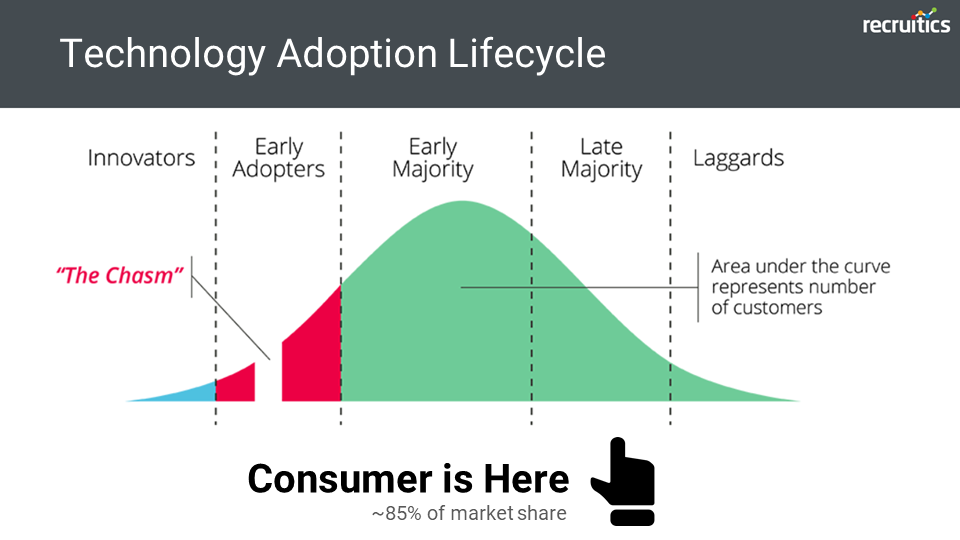

As a comparison, consumer programmatic (B2B & B2C marketing) is in the late majority phase and spends about 4 out of every 5 dollars on programmatic buying platforms. Talent acquisition follows consumer programmatic with a 4-5 year lag time, so we can look back at that industry to look ahead into ours. Due to this pattern, programmatic technology adoption will likely launch into the Late Majority phase within the next few years.

Innovation and Growth to Continue

With the recent acquisitions and growth in adoptions, publishers aren’t the only ones feeling the pressure to innovate. The recruitment industry as a whole is looking for ways to keep ahead of the curve.

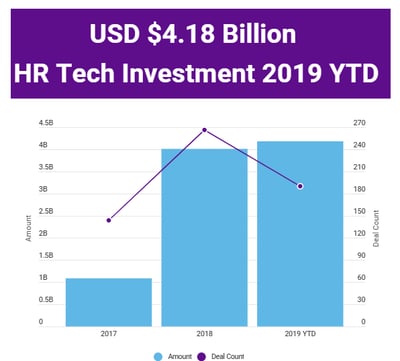

As of the end of Q3 2019, a total of $4.18 billion had been invested in HR technology, surpassing years prior and only expected to continue its growth as we head into 2020.

Peter Weddle, CEO of TAtech, says, “The Age of Programmatic is now well underway in recruitment advertising. Its ultimate success, however, will turn on both continuing technology development and accelerating customer education. Acquisitions have the potential to build the critical mass that will advance both.”

Recruitment marketing agencies, job aggregators, technology publishers, cost-per-click vendors, and other talent acquisition firms are all sprinting to fill out a complete, holistic offering of services. Programmatic is not a silver bullet, but one of the core and critical solutions that will tie together a very unified data-driven approach.

What are other talent acquisition experts saying? Thad Price of Talroo and Chad Sowash of Catch22 Consulting (and the Chad & Cheese Podcast) review what will distinguish innovation and success in the changing industry:

“Solution providers will need to evolve their product suite and talent to capitalize on the next wave of growth, especially as publishers continue to build products and offer more services to differentiate their own value prop beyond programmatic.” - Thad Price, CEO of Talroo

“Those who find simple ways to integrate automation and process efficiency into an amazing user experience will win the day. No messy integrations or dashboards. Just clean and simple connectivity focused on the end-user.” - Chad Sowash, Co-Founder of Catch 22 Consulting

The Rules Will Change

As programmatic talent acquisition technology continues to accelerate, there will be additional shifts as the industry adjusts to the new growth and the race for innovation. What will these adjustments look like?

For one, feed updates and how we count clicks will need to be updated. With more standards will come more transparency and ad quality. Having more regulation, focus, and effort around transparency and ad quality is a huge issue as programmatic grows. We’ll see a stronger focus further down the funnel in buying with less interest in what the cost per click is and more on what the cost per application is. We’ll have the opportunity through technology innovation to really focus on quality.

I also asked TA expert Matt Plummer of ZipRecruiter his thoughts, and here’s what he said:

“We'll see a period of time where CPA alone incorrectly guides buying decisions. This will cause a big push for post-apply metrics to be fed into buying platforms to enable smarter decisions on CPQA, CPH, CPQH, etc.” - Matt Plummer, VP of Product Strategy at ZipRecruiter

From additional regulation and transparency to ad buying and CPAs, it’s clear that the industry is changing.

More Consolidation to Come

The acquisition earthquake may have struck last summer, but the aftershocks will continue to rattle the industry well into 2020. Alex Murphy of JobSync and Joel Cheesman of Ratedly both predict more consolidations to come and that they’re even necessary for a healthy, well-balanced market.

Alex Murphy, CEO of JobSync, comments, “The lines are blurring; agencies are becoming technology providers, technology providers are becoming agencies. With the surge of investment capital into the HRtech space over the last 6 years, this consolidation is necessary to tear down the noise in the space that has rendered buyers parallelized and deaf, giving everyone room to think and act.”

Alex Murphy, CEO of JobSync, comments, “The lines are blurring; agencies are becoming technology providers, technology providers are becoming agencies. With the surge of investment capital into the HRtech space over the last 6 years, this consolidation is necessary to tear down the noise in the space that has rendered buyers parallelized and deaf, giving everyone room to think and act.”

Joel Cheesman, Founder of Ratedly says, “The feeding frenzy around programmatic ad solutions underscores the imbalance between buyers and sellers. There are way more interested buyers, so don't be surprised to see the remaining few players actually sell for more than the original prices paid for the first round of deals. A few years from now, we may be amazed at the bargain-basement price paid for Appcast.”

Joel Cheesman, Founder of Ratedly says, “The feeding frenzy around programmatic ad solutions underscores the imbalance between buyers and sellers. There are way more interested buyers, so don't be surprised to see the remaining few players actually sell for more than the original prices paid for the first round of deals. A few years from now, we may be amazed at the bargain-basement price paid for Appcast.”

It may be winter now, but for programmatic job advertising technology, things are only heating up. I can guarantee that no matter what happens when we look back at the industry this time next year, things will look very different.

[Watch my full TAtech Presentation on The Future of Programmatic Here]

Other Recruitment Industry Acquisitions in 2019

Programmatic wasn’t the only area of talent acquisition that saw huge shifts in 2019. The recruitment industry experienced many changes, mergers, and acquisitions that left it looking a whole lot different a year later. Below are some of the newsworthy happenings.

January 2019:

- January 10, 2019 - OutMatch, a talent assessment technology provider, acquires Wepow, a video interview firm

- January 11, 2019 - StepStone acquires e-learning platform Studydrive

February 2019:

- February 5, 2019 - Recruitment solutions provider Jobijoba acquires artificial intelligence chatbot, JAI

- February 7, 2019 - Hired acquires Py, a creator of app-based interactive courses

- February 11, 2019 - Jobvite raises $200M+ and acquires three recruitment startups

- February 12, 2019 - Australian job board, Seek, acquires start-up GradConnection

June 2019:

- June 18, 2019 - iCIMS acquires Jibe, a SaaS recruiting technology

August 2019:

- August 15, 2019 - Upward.net acquires Proven, a job site that focuses on small businesses

- August 20, 2019 - IAC acquires nursing marketplace NurseFly

November 2019:

- November 4, 2019 - Symphony Talent acquires Smashfly Technologies

- November 29, 2019 - Figaro Classifieds acquires Golden Bees, a programmatic recruitment platform

Learn more about the shifts in the recruitment industry in 2019 from the Job Board Doctor.

Related Articles:

- What’s Next for the Future of Programmatic (VIDEO)

- What is Programmatic Job Advertising?

- Programmatic Job Advertising: Case Study

- The Year in Review: What Happened with Job Boards and Recruitment Marketing

Have any thoughts on the future of programmatic job advertising technology? Share them with us on social email us at info@recruitics.com.